corporate tax increase proposal

Raise the corporate income tax rate to 28 percent. Corporations by 9636 billion over the next decade.

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Eighty-seven percent of these revenues are raised from 5 major changes to the corporate tax code though the proposal to raise the US.

. President Bidens so-called American Jobs Plan proposes to increase the corporate rate to 28 percent. 13 trillion tax increase. The plan would invest nearly 79 billion in IRS tax enforcement.

Increase the corporate tax rate to 28. Increased from 21 to 265. Corporate income tax rate.

A Quick Take on the Houses Proposal. Raises about 191b per year according to JCT. Democratic presidential candidate Joe Biden has promised not to raise taxes on anyone making less than 400000 a year but his proposal to raise the corporate tax rate from 21 to 28 would result.

The top marginal tax rate will increase from 37 to 396 for taxable income over 450000 for married individuals filing a joint return 400000 for unmarried individuals. This is a cornerstone of the proposed tax increases. 396 top individual rate.

The proposed corporate tax rate changes would be effective for tax years beginning after December 31 2021. The proposal would increase the capital gains tax rate for those with an income above 400000 to 25 from the current 20 and include an additional 3 surcharge on taxable income over 5 million. Senator Amy Klobuchar D-MN has proposed raising the corporate tax rate to 25 percent.

A new 18 corporate tax rate would be applied for businesses with income below 400000. Revenue provisions in the proposed budget prominently include what an administration fact sheet calls a new billionaire minimum income tax of 20 on both realized and unrealized gains and other income of the nations wealthiest individuals. Biden says will raise about 1t and that it will still be much lower than the 35 in 2017.

Raise the maximum corporate rate. This is estimated to raise 13 trillion in additional tax. Today the federal tax rate on corporations is 21 down from the 35 rate that was in effect before the 2017 Republican tax restructuring.

Subtitle I Corporate and International Tax Reforms. The tax would apply only to companies that publicly. President Biden made a renewed push on Monday to galvanize congressional Democrats to overhaul the nations tax code and dramatically raise rates on corporations and ultra-wealthy Americans.

Key Points New details of a Democratic plan to enact a 15 minimum corporate tax on declared income of large corporations were released Tuesday. Ways and Means Committee Chairman Richard Neal has proposed 25 new tax policies that would on net raise taxes on US. Corporate Tax Rate Increase President Bidens administration has made a proposal to increase the corporate tax rate.

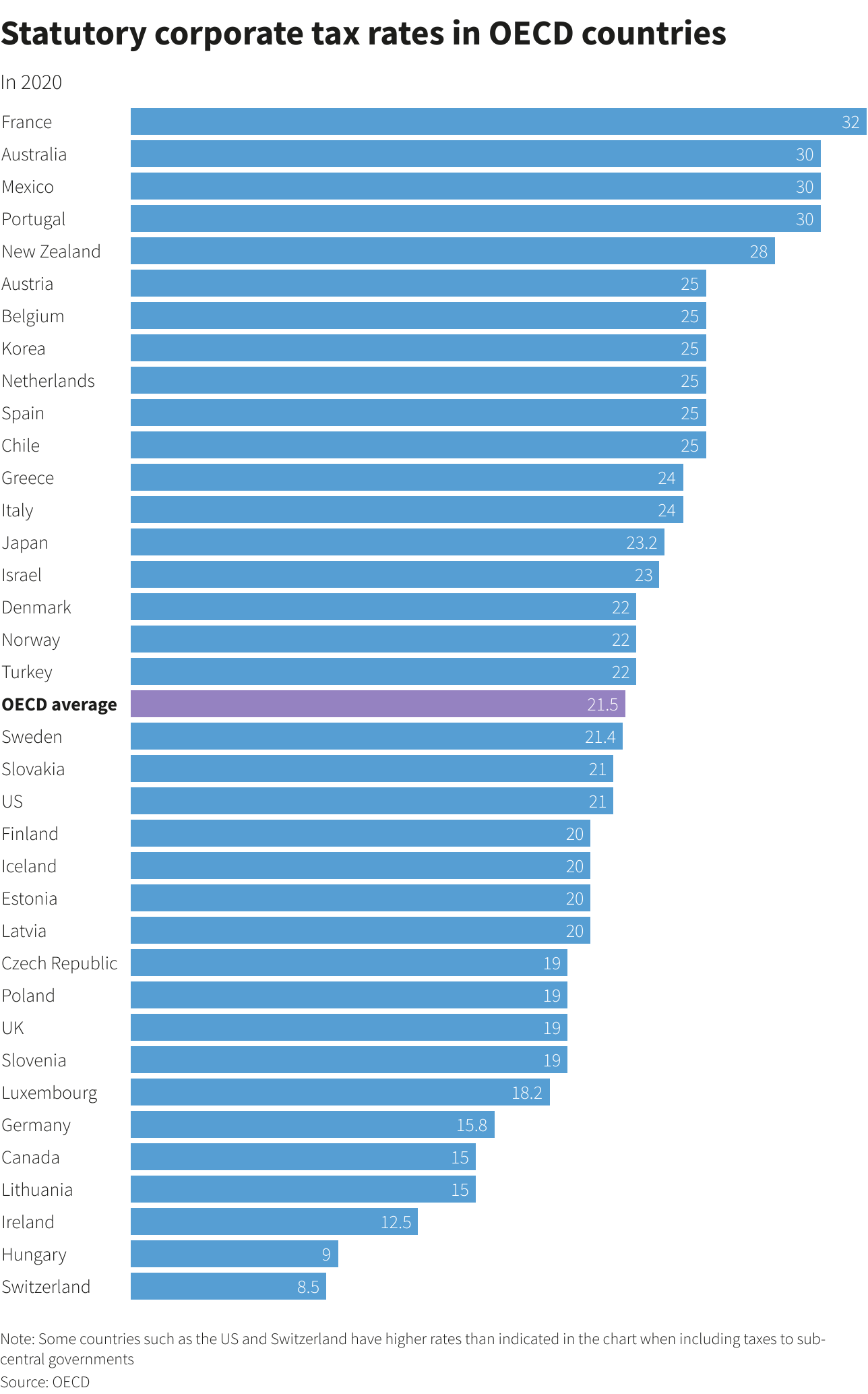

For corporations with income 2b. 4 rows Corporation tax rate increase from April 2023 will result in the return of the small profit. After accounting for state corporate taxes Biden will give the US.

This is an increase from the current 21 to 28. Rather than the 21 enjoyed by many businesses from the Tax Cuts Jobs Act of 2017 C corporations would see a new 28 flat tax rate. A 21 rate would apply to corporate income between 400000 and 5 million.

And Senator Elizabeth Warren D-MA Senator Bernie Sanders I-VT former HUD Secretary Julián Castro and South Bend Indiana Mayor Pete Buttigieg have. 396 capital gains rate for incomes over 1m. The top rate on capital.

Including state tax the tax rates on US. At Budget 2020 the government announced that the Corporation Tax main rate for all profits except ring fence profits for the years starting 1 April 2020 and 2021 would be 19. There is a lot of concern among small business owners about how Democrats in Congress will pay for their legislative priorities.

Corporations including income from countries that. Former Vice President Joe Biden and Governor Steve Bullock D-MT have suggested raising the rate to 28 percent. Corporations would rise to.

The Democratic proposal would raise the top corporate tax rate from 21 to 265 less than the 28 Biden had sought people familiar with the matter said Sunday night. One of these concerns is the potential increase in the top corporate tax rate from 21 to 28. Businesses with income of at least 400000 but less than 5 million would remain subject to the 21 rate.

15 minimum tax based on book income. A 32 percent corporate rate a tax rate significantly higher than Communist Chinas 25 percent tax rate. Taxpayers subject to the 38 net investment income tax will see a total Federal capital gains rate of 288 a 20 increase.

Note that this change would be effective as of the date of the Acts introduction ie. September 14 2021. This tax increase will be passed along to families in the form of higher prices of goods and services.

The tax rate for C corporations will increase from 21 to 28. Increase the minimum corporate tax rate to 21 for all US. 28 corporate rate.

The budget also would increase the corporate tax rate from the current 21 to 28 and institute measures supporting.

Biden Banks On 3 6 Trillion Tax Hike On The Rich And Corporations The New York Times

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Federal Tax Cuts In The Bush Obama And Trump Years Itep

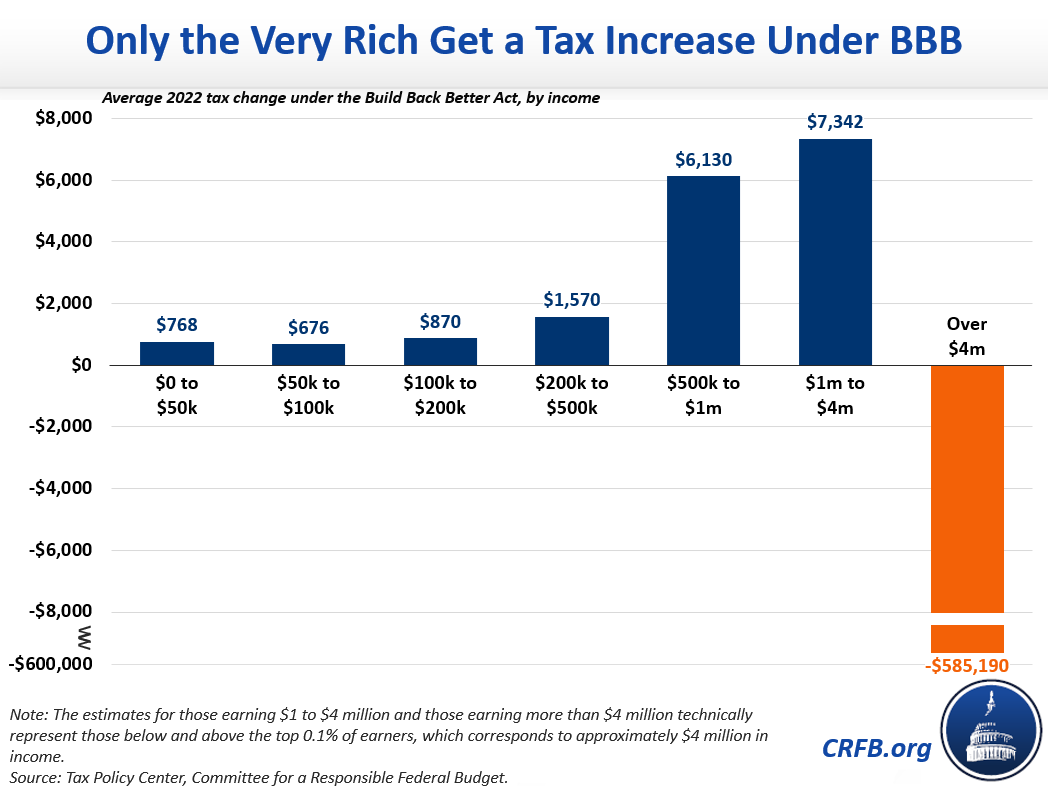

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Tax Cuts And Jobs Act Tcja Taxedu Tax Foundation

Countries Agree With Plan To Set Minimum Corporate Tax Rate World Economic Forum

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Trump S Corporate Tax Cut Is Not Trickling Down Center For American Progress

Us Offers New Plan In Global Corporate Tax Talks Financial Times

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Scott S Skin In The Game Plan Could Raise Taxes By 100 Billion In 2022 Mostly On Low And Moderate Income Households

Individual And Corporate Tax Reform

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

President Biden Unveils Plan To Raise Corporate Taxes The New York Times

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)