texas estate tax rate

Counties and Celina in addition to thousands of special purpose districts hold taxing authority given by Texas law. To view the entire 2021 Tax Rate Notice PDF click here.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Learn about Plano TX property tax rates homestead exemption Irving Top Realtor and Plano Luxury Home Realtor Real Estate Agent.

. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in.

Property tax exemptions reduce the appraised value of your real estate which can reduce your tax bill. Texas law establishes the process followed by local officials in determining the value for property ensuring that values are equal and uniform setting tax rates and. In Texas the highest watermark was.

This interactive table ranks Texas counties by median property tax in dollars percentage of home value and percentage of median income. The tax rates included are for the year in which the list is prepared and must be listed alphabetically according to the county or counties in which each taxing unit is located and by the name of each taxing unit. Median property tax is 227500.

Homeowners have to pay these fees usually on a monthly basis in combination with their mortgage payments. 4min read 808 views. In San Antonio the countys largest city and the second-largest city in the entire state the tax rate is 261.

2021 Property Tax Town Hall. In each case these rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. You can sort by any column available by clicking the arrows in the header row.

Texas is one of seven states that do not collect a personal income tax. In 2019 the Texas Legislature passed legislation to help Texans better understand tax rates in their home county. A tax rate of 18 applied to an appraised value of 200000 works out to more than 18 of an.

Property Tax Transparency in Texas. The average property tax rate in Texas is 180. Click here for notice.

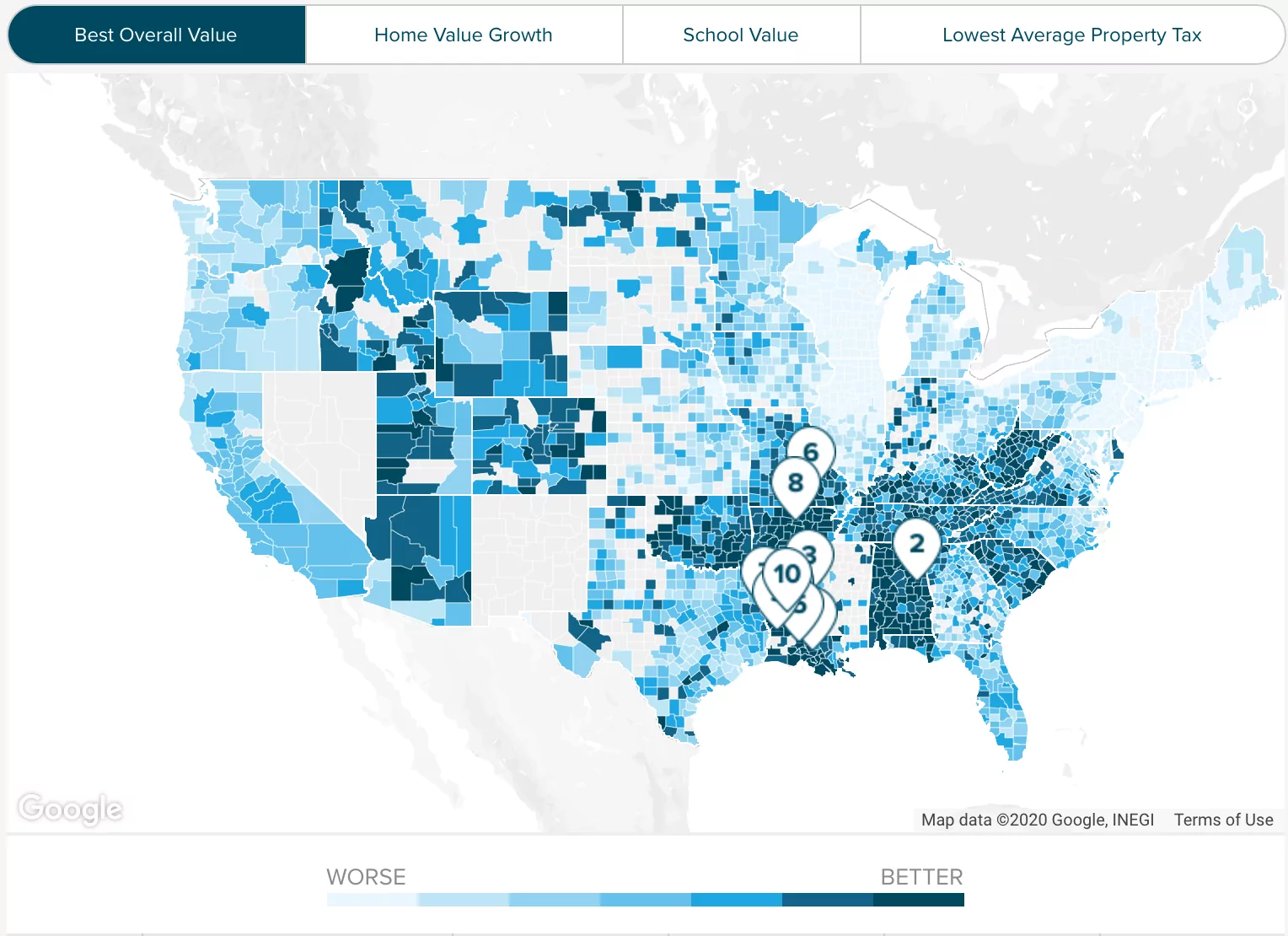

Property taxes in Texas are the seventh highest in the United States with the average effective property tax rate in Lone Star State of 169. That means Texans pay 3907 annually in property taxes on a median-priced home in the US which is 217500. The Lone Star State ranks 45th in the nation with a tax rate of 180.

Breaking this out in dollars if your home is valued at 200000 your personal property taxes at the average rate of 180 would be 3600 for the year. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. Texas Tax Code Section 2518 calls for new real estate appraisals in three years or fewer intervals.

There are three basic steps in taxing property ie devising tax rates appraising property market worth and receiving tax revenues. 2021 Property Tax Rate The City of North Richland Hills property tax rate for 2021 is 0572184 per 100 property valuation. This years no-new-revenue tax rate0475526100.

The voter-approval tax rate is the highest tax rate a taxing unit can adopt without holding an election. Texas Property Tax Exemptions. The property tax in Texas averages an effective rate of 169 which is one of the nations highest marks.

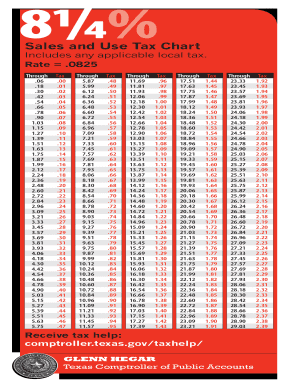

Finally the state sales tax base is 625 but in most big Texan cities its 825. Texas has no state income tax. However revenue lost to Texas by not having a personal income tax may be made up through other state-level taxes such as the Texas sales tax and the Texas.

The rates are given per 100 of property value. The rates are given per 100 of property value. Only the Federal Income Tax applies.

Typically appraisers lump together all like properties located in the same community and collectively apply one-fits-all evaluation measures. The City Council adopts a property tax rate annually as part to of the citys budget process. Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets roads police fire protection and many other services.

1 of the following year as required. The list is sorted by median property tax in dollars by default. To learn more about this process please visit our budget webpage.

Texas Property Taxes Overview in 2021. Compare that to the national average which is currently 107. Property taxes or real estate taxes are paid by a real estate owner to county or local tax authoritiesThe amount is based on the assessed value of your home and vary depending on your states property tax rateMost US.

The average homeowner in Bexar County pays 2996 annually in property taxes on a median home value of 152400. The Williamson Central Appraisal District is a separate local agency and is not part of Williamson County Government or the Williamson County Tax Assessors Office. The Williamson Central Appraisal District is located at 625 FM 1460 Georgetown TX 78626 and the contact number is 512-930-3787.

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. To estimate your real estate taxes you merely multiply your homes assessed value by the levy.

The Comptrollers Property Tax Assistance Division PTAD publishes this list not later than Jan. The budgets adopted by taxing units and the tax rates they set to fund those budgets play a significant role in determining the amount of taxes each property owner pays. This is currently the seventh-highest rate in the United States.

Finally the state sales tax base is 625 but in most big Texan cities its 825. This years voter-approval tax rate0579017100. Texas has 254 counties with median property taxes ranging from a high of 506600 in King County to a low of 28500 in Terrell CountyFor more details about the property tax rates in any of Texas counties choose the county from the interactive map or the list below.

How Do State And Local Individual Income Taxes Work Tax Policy Center

Over 65 Property Tax Exemption In Texas

Texas Sales Tax Small Business Guide Truic

Sales And Use Tax Rates Houston Org

How High Are Capital Gains Taxes In Your State Tax Foundation

Harris County Tx Property Tax Calculator Smartasset

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Texas State Taxes Forbes Advisor

Texas Estate Tax Everything You Need To Know Smartasset

Sales Tax Chart Fill Out And Sign Printable Pdf Template Signnow

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Estate Tax Everything You Need To Know Smartasset